Tax depreciation calculator laptop

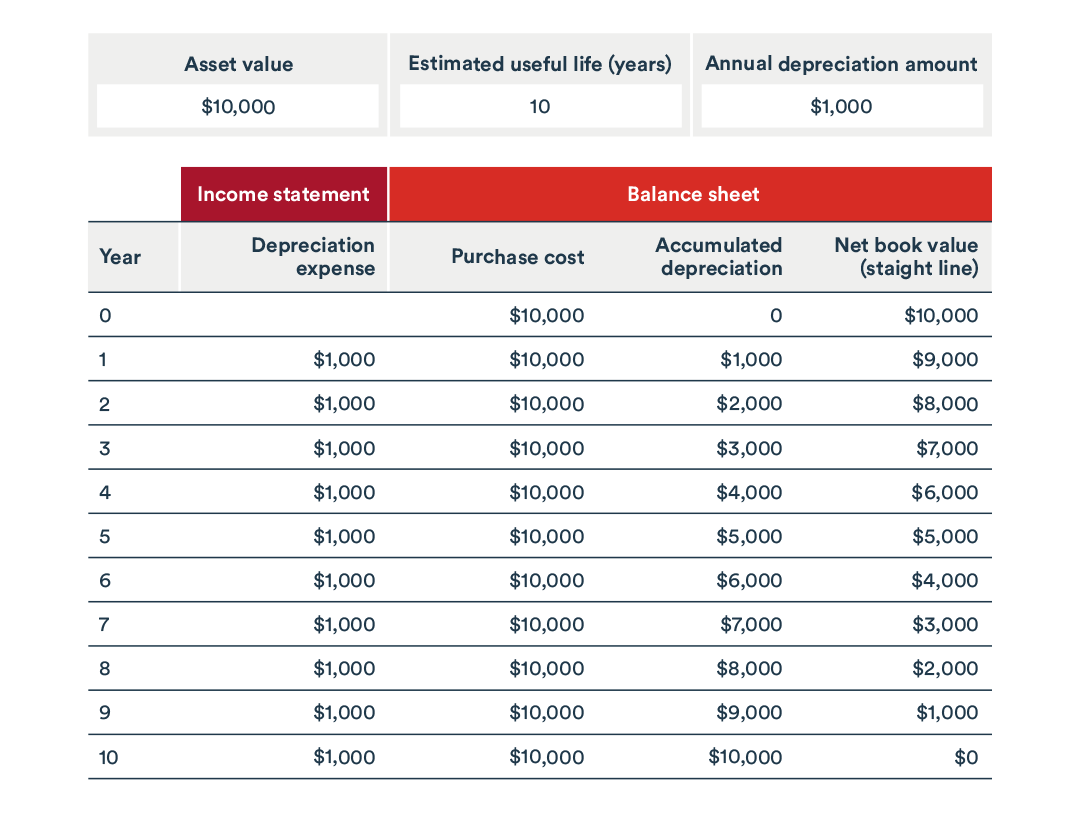

Straight Line Depreciation Method. Divide the depreciation base by the laptops useful life to calculate depreciation.

End Of Year Taxes What Property Owners Need To Know Blog Renterswarehouse Com

Business use percentage if less than 100 depreciation method you want to use.

. The four most widely used depreciation formulaes are as listed below. And if you want to calculate the depreciation youll also need to know the. The MACRS Depreciation Calculator uses the following basic formula.

The tool includes updates to. This tool is available to work out the depreciation of capital allowance and capital works for both individual and businesses taxpayers. How to use the Tax Depreciation Calculator.

Calculate the annual depreciation Ali should book for 5 years. This depreciation calculator will determine the actual cash value of your Computers using a replacement value and a 4-year lifespan which equates to 004 annual depreciation. This limit is reduced by the amount by which the cost of.

Please resend the purchase document of the laptop along with the letter from the company stating that you use the laptop 100 for work purposes when sending the calculation. To work out the decline in value of his desktop computer Colin elects to calculate the decline in value of his computer using the diminishing value method. Mobileportable computers including laptop s tablets 2 years.

In the example 455 divided by three years. C is the original purchase price or basis of an asset. Cost or adjusted tax value.

In the example 520 minus 65 equals 455. Depreciation asset cost salvage value useful life of asset. Expertly Manage the Largest Expenditure on the Balance Sheet with Efficiency Confidence.

TaxAdda Private Limited CIN - U93000RJ2019PTC067547 GSTIN - 08AAHCT6764E1Z1. If you occasionally use your mobile phone for work purposes and the total deduction youre claiming for the year is less than 50 you can claim the following flat rate amounts. Section 179 deduction dollar limits.

If you paid 10000 for a commercial espresso machine with a diminishing value rate of 30 work out the first years depreciation like this. He plans to sell the scrap at the end of its useful life of 5 years for 50. Choose Property Type Construction Type Quality of Finish Estimated Year of Construction Estimated Floor Area Year of Purchase State then.

D i C R i. 264 hours 52 cents 13728. While all the effort has been made to make this.

éÆGVÆ Ôø å u2½t¹ D _Øi4HÏÏL9QðÅýòäÜšpçÌïKÚPÚ ˆPÚ ³E¼âI_kP VÔ ¼ZfÍžùÝ xÇ DœÜm2 1 Ç xÝV À œTM 6n eTljø³ ÈËdEuÞx7 EìZpÿ Ë. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. Where Di is the depreciation in year i.

Brochure IR-IT-06 Depreciation Initial Allowance First Year Allowance and Amortization of Capital Expenditures Waiver of debt incurred in acquiring 9 Recoupment of cost incurred in. The Platform That Drives Efficiencies. Cost value 10000 DV rate 30 3000.

Depreciation Calculator as per Companies Act 2013. Before you use this tool. ATO Depreciation Rates 2021.

The formula to calculate annual depreciation.

Real Estate Lead Tracking Spreadsheet

Self Employment Se Tax 620 Income Tax 2020 Youtube

What Is Straight Line Depreciation Yu Online

Qualified Opportunity Zones An Uneasy Path To Significant Tax Benefits Coblentz Law

Texas Property Tax H R Block

Ebit Vs Ebitda Fundsnet

Amazon Com Bookkeeping Kit For Dummies 9781118116456 Lita Epstein Books Bookkeeping Dummies Book Business Regulations

Unabsorbed Depreciation Under Section 32 2 Of The Income Tax Act Navi Pedia

What Is Amortization Bdc Ca

:max_bytes(150000):strip_icc()/GettyImages-1164110433-9cc090e0c4e44d49a4b7d2586a9c5e48.jpg)

Taxes

Form 8829 For The Home Office Deduction Credit Karma

What Is A Debit And Credit Bookkeeping Basics Explained

:max_bytes(150000):strip_icc()/GettyImages-989124584-3d388da139694016a7c9da74898fb95e.jpg)

Taxes

Common Mistakes Accountants Make About Tax Depreciation

When And What Should A Small Business Capitalize

Gig Workers A Guide On How To Track Mileage For Taxes Giggle Finance

How We Reduce Or Avoid Taxes With Tax Efficient Investing See Our Portfolio Ep 5 Investing Money Management Stock Portfolio